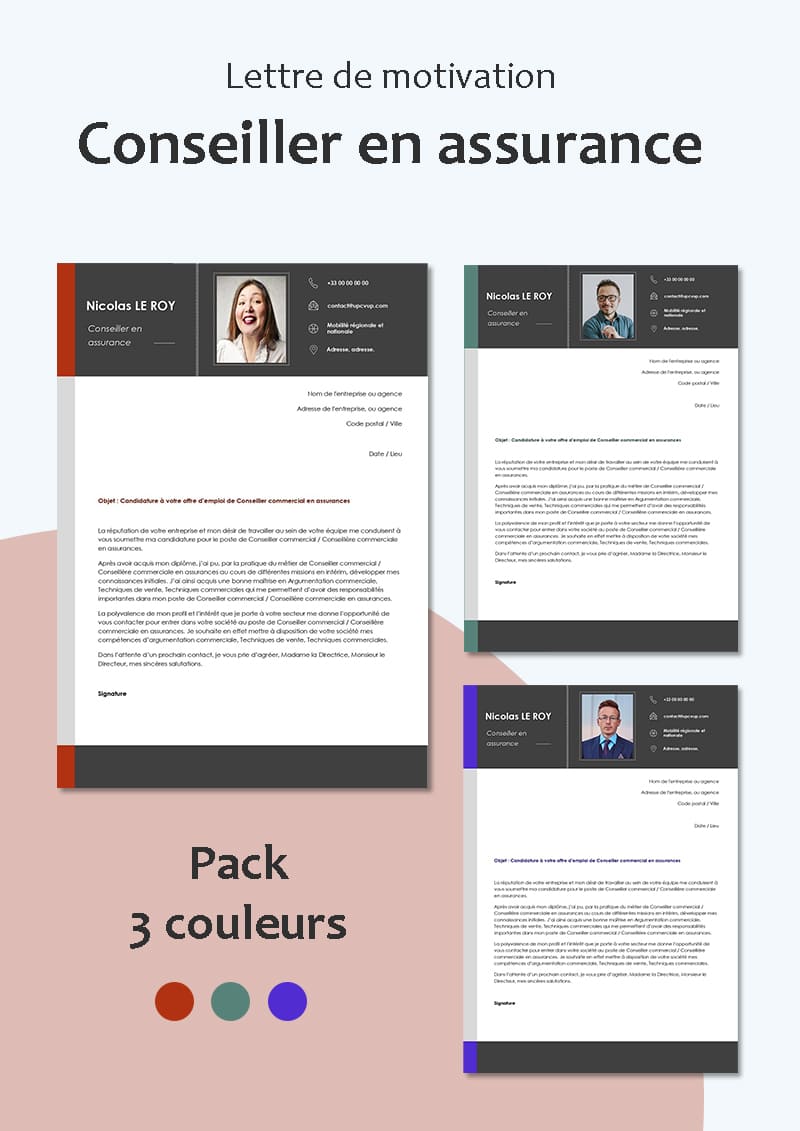

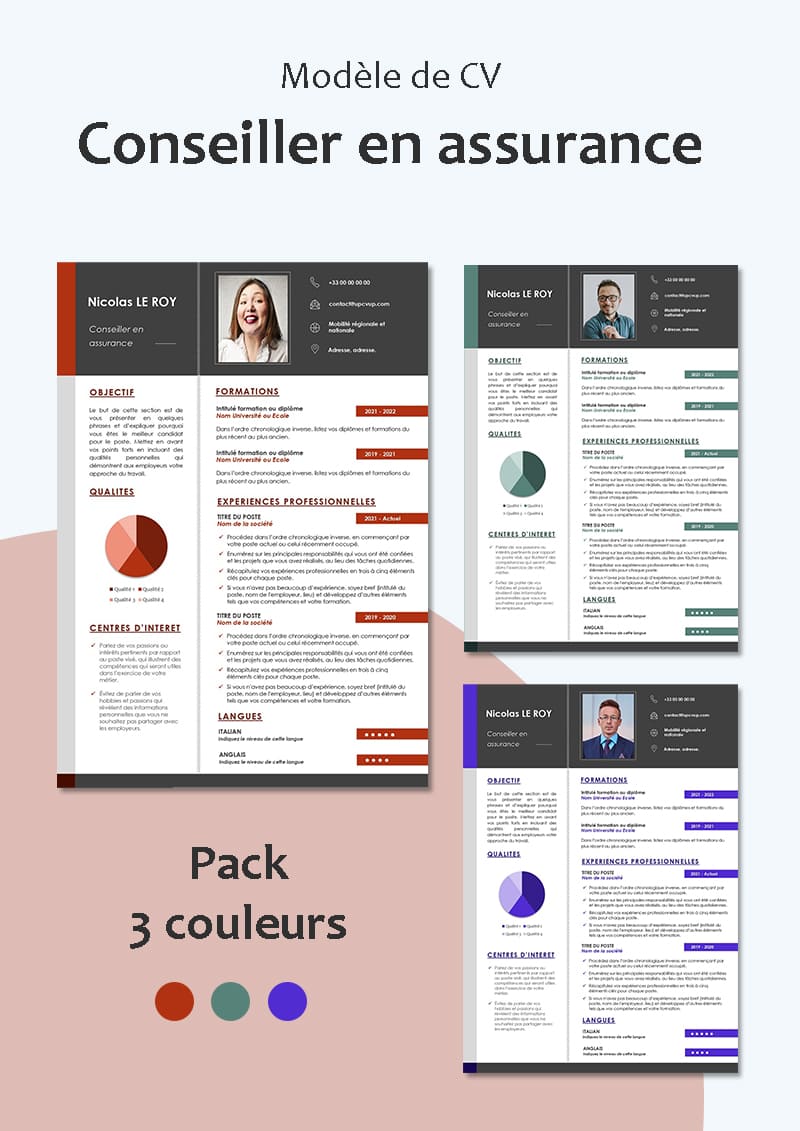

Insurance Advisor Resume Template

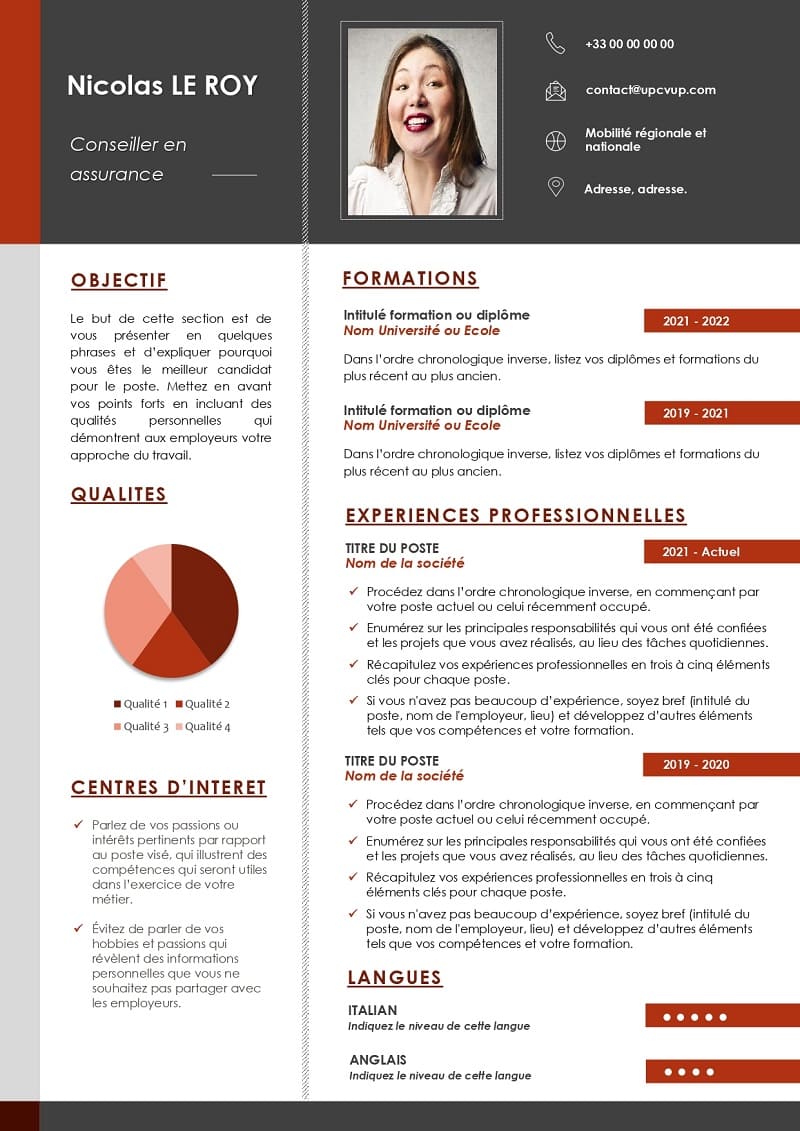

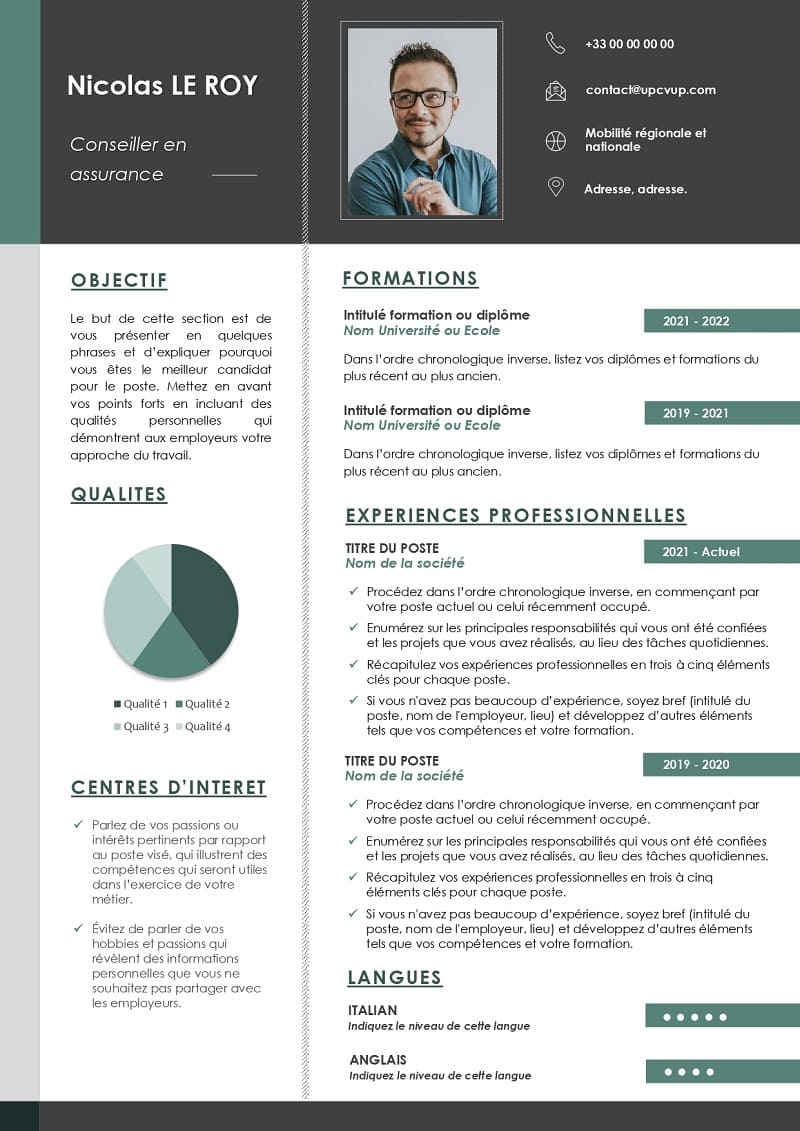

This Insurance Advisor Resume template is designed to make a lasting impression, whether you’re applying for an entry-level position or one requiring years of experience. A meticulously crafted and well-structured resume like this is sure to leave a strong impact on the reader. The content is thoughtfully organized into sections, resulting in a layout that is truly one-of-a-kind. Every aspect of this CV is modern and innovative without straying too far from proven insurance advisor CV templates, signaling to the recruiter that you are open to and comfortable with new ideas and practices.

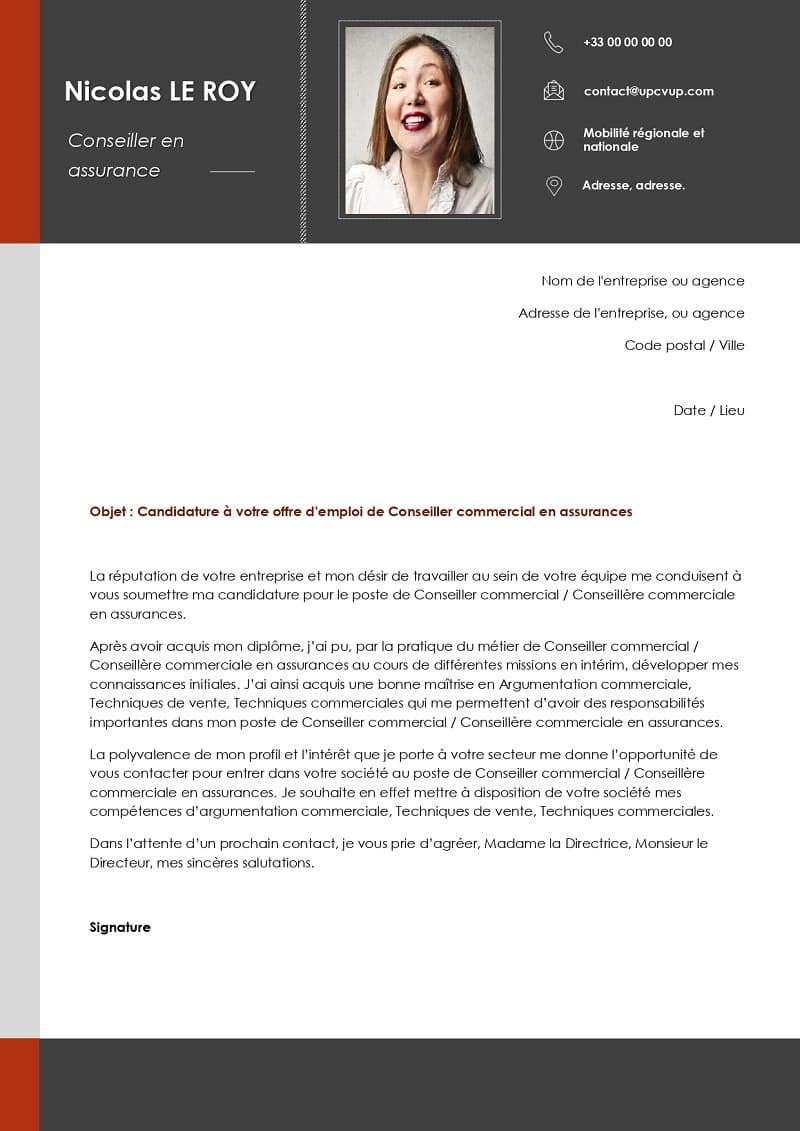

We provide this CV in three different Word formats, each accompanied by cover letters to help you submit a competitive application tailored to the position you are seeking.

🌟 Resume in 3 colors with cover letters.

📝 100% customizable : colors, fonts, icons, etc.

📎 Modern resume in Word format (Windows and MacOS).

⏳ Fast assistance (guaranteed response in less than 2 hours).

💰 One-time payment. No commitment. No subscription.

For any questions, please do not hesitate to contact us at contact@upcvup.com

🌟 Unlock Your Insurance Career Potential with Our Exclusive Resume Template!

Are you an aspiring or seasoned Insurance Advisor looking to make a lasting impression? Look no further! Our Insurance Advisor resume template is meticulously designed to showcase your skills and experience in a way that stands out. Here’s why it’s a game-changer:

🎯 Strategic Content: Tailored sections to highlight your expertise, from risk assessment to client relations, ensuring every aspect of your profile shines.

🖼️ Modern Design: Impress recruiters with a contemporary layout that is both visually appealing and professionally aligned with industry standards.

🛠️ Customizable Elements: Personalize your resume to reflect your unique strengths and achievements. Showcase your skills, certifications, and experience effortlessly.

🔍 Keyword Optimization: Weaved with industry-specific keywords to ensure your resume gets noticed by applicant tracking systems (ATS) and human recruiters alike.

🏆 Proven Structure: A balanced blend of innovation and time-tested Insurance Advisor CV templates, demonstrating your adaptability to modern practices.

✨ Versatility: Suitable for both entry-level candidates and seasoned professionals, this template adapts to your experience level seamlessly.

📑 Comprehensive Package: Available in three different Word formats, each accompanied by cover letters crafted to enhance your application’s competitiveness.

🚀 Take the First Step Towards Your Dream Role:

Your insurance career journey begins with a compelling resume. Download our Insurance Advisor resume template today and let your qualifications shine. Secure interviews, make an impact, and elevate your career in the dynamic world of insurance!

Crafting an Effective Insurance Advisor Resume in 2024 ?

In the competitive realm of insurance, a well-crafted resume is your passport to opening doors to new opportunities and advancing your career. As an Insurance Advisor, your resume is not just a document; it’s a reflection of your skills, experience, and the value you bring to the industry. This article provides a comprehensive guide on how to write a compelling Insurance Advisor resume that will make you stand out in a crowded job market.

1️⃣ Start with a Powerful Objective Statement : Open your resume with a concise yet impactful objective statement. Clearly communicate your career aspirations, highlighting your strengths and the specific value you bring to the insurance sector. Tailor this statement to the position you’re applying for, showcasing your expertise in risk assessment, client relations, and other relevant areas.

2️⃣ Highlight Key Skills : In a dedicated section, showcase your key skills. Emphasize a mix of technical skills, such as proficiency in insurance software and risk analysis, as well as soft skills like effective communication, negotiation, and relationship building. This section should align with the specific requirements of the job you’re targeting.

3️⃣ Showcase Professional Experience : Detail your work experience with a focus on achievements and responsibilities. Highlight successful client interactions, policy sales, and any initiatives you’ve undertaken to improve processes or enhance customer satisfaction. Use quantifiable metrics where possible to demonstrate the impact of your contributions.

4️⃣ Demonstrate Industry Knowledge : In a competitive field like insurance, showcasing your industry knowledge is crucial. Include relevant certifications, such as Chartered Insurance Professional (CIP) or Certified Insurance Counselor (CIC), to validate your expertise. Mention ongoing professional development activities to highlight your commitment to staying current in the field.

5️⃣ Tailor Your Resume for Each Application : Customize your resume for each job application by aligning your qualifications and skills with the specific requirements of the position. Use keywords from the job description to pass through applicant tracking systems and capture the attention of recruiters.

Crafting the Perfect Career Summary for Your Insurance Advisor CV

In the competitive field of insurance, a well-crafted career summary at the beginning of your CV can make a significant difference in catching the attention of potential employers. This article will explore five types of career summaries tailored specifically for an Insurance Advisor CV, providing insights on how to effectively showcase your skills, experience, and career goals.

1️⃣ Experienced Professional Career Summary : “Accomplished Insurance Advisor with over a decade of experience in risk assessment, policy development, and client relations. Proven track record of exceeding sales targets and implementing innovative strategies to optimize insurance portfolios.”

2️⃣ Industry-Specific Career Summary : “Insurance Advisor specializing in property and casualty insurance, adept at navigating complex regulatory environments. Proficient in underwriting processes, risk analysis, and leveraging industry trends to provide clients with tailored coverage solutions.”

3️⃣ Skills-Focused Career Summary : “Results-driven Insurance Advisor skilled in market analysis, client acquisition, and policy customization. Proven ability to leverage advanced analytical tools for risk assessment and develop comprehensive insurance solutions. Strong interpersonal and negotiation skills.”

4️⃣ Managerial/Leadership Career Summary : “Accomplished Insurance Advisor with a strong leadership background, leading high-performing teams and driving revenue growth. Expertise in strategic planning, team development, and implementing efficient insurance processes.”

5️⃣ Career Change Career Summary: “Dynamic professional with a successful track record in sales, transitioning to a rewarding career as an Insurance Advisor. Leveraging a robust background in client relationship management, I bring a fresh perspective and determination to excel in the insurance industry.”

How to Tailor Your Career Summary:

-

Know Your Audience: Understand the specific requirements of the job and the company culture to tailor your career summary accordingly.

-

Highlight Relevant Achievements: Focus on measurable achievements and experiences that directly align with the insurance industry, such as successful policy negotiations, client retention rates, or expertise in a specific insurance niche.

-

Emphasize Soft Skills: In addition to technical skills, emphasize soft skills such as communication, problem-solving, and adaptability – crucial for building rapport with clients and navigating the dynamic insurance landscape.

-

Quantify Your Impact: Use quantifiable metrics wherever possible to demonstrate the impact of your contributions, whether it’s revenue growth percentages, successful policy conversions, or client satisfaction ratings.

-

Express Enthusiasm for the Role: Convey your passion for the insurance industry and your commitment to providing exceptional service to clients. A genuine enthusiasm for the role can set you apart from other candidates.

Crafting a compelling career summary for your Insurance Advisor CV is an essential step toward securing your desired position in the industry. Whether you’re an experienced professional or undergoing a career change, tailoring your career summary to showcase your unique strengths and align with the specific job requirements will undoubtedly make your CV stand out. Remember, your career summary is your first chance to make a positive impression, so make it count!

Compétences à mettre sur un CV de conseiller en assurance

Insurance Advisor Resume Template

Insurance Advisor CV Example (Entry-level)

[First Name Last Name]

[Address]

[Phone]

[Email]

Professional Objective

Entry-Level Insurance Advisor seeking to build a career in the insurance industry where I can apply my skills in sales, client advisory, and risk management to provide adequate protection to clients and achieve company objectives.

Professional Experience

[Dates]

Sales Advisor (Internship) – [Company Name] – Paris

- Assisted insurance advisors in their daily tasks.

- Engaged in prospecting new clients and managing incoming inquiries.

- Contributed to the development of personalized insurance proposals.

- Responded to client inquiries and guided them through the subscription process.

[Dates]

Insurance Internship – [Company Name] – Paris

- Assisted the insurance team in managing existing policies.

- Participated in evaluating client risks and recommending suitable coverages.

- Collaborated with insurance agents to provide quality customer service.

Education

- Bachelor’s in Insurance and Risk Management (University/School), [Year]

- DUT Marketing Techniques (University/School), [Year]

Skills

- In-depth knowledge of insurance products, including life insurance, automobile insurance, and home insurance.

- Ability to identify client needs and recommend appropriate insurance products.

- Excellent verbal and written communication skills to explain insurance terms and conditions to clients.

- Mastery of sales techniques and the ability to negotiate contracts.

- Understanding of risk management principles and the ability to assess risks to propose tailored solutions.

- Good knowledge of computer tools and software used in the insurance industry.

Interests

- Member of the “Insurance XYZ” association

- Volunteer work with the Red Cross

Languages

- French (native)

- English (intermediate)

Experienced Insurance Advisor Resume Example

[First Name Last Name]

[Address]

[Phone]

[Email]

Professional Summary

Experienced Insurance Advisor with over 10 years of comprehensive industry knowledge and a proven track record of delivering exceptional results. Adept at building and maintaining client relationships, evaluating risks, and tailoring insurance solutions to meet diverse client needs. Proven success in exceeding sales targets, providing strategic advisory services, and contributing to the overall growth and profitability of insurance agencies. Seeking to bring extensive expertise and a client-centric approach to a dynamic insurance environment.

Professional Experience

Senior Insurance Advisor | XYZ Insurance Services, City, State | [Dates]

- Spearheaded the development and implementation of targeted sales strategies, resulting in a consistent 15% annual increase in revenue.

- Managed a portfolio of high-net-worth clients, providing customized insurance solutions and ensuring overall client satisfaction.

- Led a team of junior advisors, providing mentorship and training to enhance their sales and advisory skills.

- Conducted regular risk assessments for clients, identifying potential exposures and recommending appropriate coverage enhancements.

Insurance Consultant | ABC Brokers, City, State | [Dates]

- Played a pivotal role in expanding the client base by 20% through effective prospecting and relationship-building activities.

- Developed and maintained strong relationships with insurance underwriters, negotiating favorable terms and ensuring competitive offerings for clients.

- Implemented innovative client education programs, resulting in increased client understanding of insurance products and improved retention rates.

- Conducted regular market analyses to stay abreast of industry trends and identify new business opportunities.

Education

- Bachelor of Business Administration in Insurance and Risk Management | [University Name], [Year]

Certifications

- Certified Insurance Counselor (CIC)

- Chartered Property Casualty Underwriter (CPCU)

Skills

- Expertise in various insurance products, including life, health, property, and casualty.

- Advanced proficiency in risk assessment and underwriting processes.

- Strong negotiation and sales skills, consistently exceeding sales targets.

- Exceptional interpersonal and communication skills for effective client engagement.

- In-depth knowledge of industry regulations, compliance, and market trends.

- Proficient in utilizing insurance software and technology tools.

Professional Memberships

- Member, National Association of Insurance and Financial Advisors (NAIFA)

- Member, Risk and Insurance Management Society (RIMS)

Languages

- Fluent in English and Spanish

Service de rédaction de CV par des pros !

Recevez votre nouveau CV personnalisé sous 48h.

Les personnes ayant téléchargé ce modèle ont également acheté

Instant Download

Immediate download, no account required.

CV + Cover Letter

To send a complete and effective application.

Satisfaction guaranteed

Free CV exchange, personalized assistance via chat and e-mail.

Secure payment

SSL encryption for secure payments.